Successful TPD Claims

Will you pay tax on your Total and Permanent Disability (TPD) claim?

Answer: The TPD claim itself is not taxable, however, the subsequent withdrawal from the superannuation account will be taxable if the person is under age 60.

Disclaimer: please understand that this blog article is not financial advice, please do not make any financial decisions based on the information in this article. Every persons situation is different, and even a super funds and insurers can have different processes when calculating tax on TPD claims.

This question seems to be one of the most confusing questions for people that are pursuing or have just had their TPD claim successfully approved and paid into their super account. Sometimes people are told their TPD claim will be tax free, some people are told the tax will be 22% and some people are told all sorts of other answers.

So to set the record straight, most TPD claims in Australia are held through a superannuation account (or “Linked/Owned” by super account). When the TPD Claim is approved, there is no tax payable, however, the TPD funds are paid into the persons super account, and then any withdrawal they make are taxed – if they are under their “preservation age”. Usually the person will be entitled to a tax-free portion, and a taxable portion which is taxed at 22%. This is why everybody will have a different tax rate, in fact, someone that has multiple TPD policies and super accounts could have quite different tax rates on each one.

The reason for this is the formula to work out the tax free portion, this formula can be found here (Tax Reference).

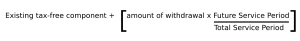

To calculate your new tax-free component of your withdrawal, the formula is as follows:

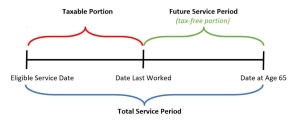

Part of the formula relies on the persons superannuation account eligible service date, which could be the date they set up their Superfund, or the date they started employment with the employer that set up the account for them, or if you roll super accounts together, the earliest date eligible service date is always retained.

Do not rollover super accounts if you’re going through TPD Client process, until you understand the consequences of this.

See Video 2 on this page for an explanation on how the tax works following the approval of a superannuation TPD claim: TPD Approved.

See this link here for a free tax calculator to work out what your personal tax rate my pay for your TPD claim: Free TPD Tax Calculator.

The taxable portion of the TPD super withdrawal is taxed. The tax is withheld by the Superfund and paid to the ATO. It should be a maximum rate of tax withheld, so you should not have to cater for tax when it comes to tax time. However, there are certain payments that can be impacted by this extra taxable income. Some of these payments and benefits include:

- Family tax benefits

- Medicare levy surcharge

- Child-support payments

- HECS or HELP debts

- Carer allowance

This list is not exhaustive. If you are concerned about any of these consequences, click on our contact us button and request our information pack and we can send you some more information on superannuation TPD Client and the and the financial implications.