Personal Injury Financial Strategies

Personal injury settlement recipients need to know about the 90-day personal injury superannuation rule – especially for those with larger settlements. This financial strategy can save thousands, or possibly tens of thousands of dollars in tax every year.

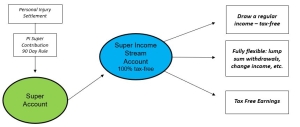

For people that receive large personal injury settlements, a common strategy is for them to make a large, after tax (or “non-concessional”) contribution into a superannuation account (which must be done within 90 days of the receipt of their settlement) and then start a superannuation income stream account (also known as an “account based pension”).

The benefits of this strategy include:

- All earnings are tax free in a super income steam account (rather than being taxed at marginal tax rates);

- All income or lump sums drawn from the account will be tax free;

- It is very flexible, the person has access to the funds at any time, money can be held in cash, term deposits and/or investment options.

Below is some information and important steps in applying this strategy. Note that this list is not complete, and you should get financial advice before implementing any of these strategies. And there can be important differences between superannuation funds when implementing these strategies.

- Personal Injury Super Contributions

Most Australians are limited by how much they can contribute into super each year. In the 2022/23 financial year, these contribution limits / or “contribution caps” are as follows:

- Tax-deductible (or Concessional) Contributions: $27,500 per financial year

- After tax (or Non-Concessional) Contributions: $110,000 per financial year, or you can “Bring Forward” the next 2 financial years and contribute up to $330,000 for a 3 year period.

However, recipients of Personal Injury Settlements receive a special exemption here: they can make an unlimited Non-Concessional Contribution into a super account, as long as it is made within 90 days of receiving this personal injury settlement.

- Superannuation Permanent Incapacity Condition

Before making any contribution into super, the individual should ensure that they meet the “Superannuation Permanent Incapacity Condition of Release”. This will ensure that the individual has full access to their super, no matter how old they are. If a person doesn’t meet this condition, their super could be locked up until they reach age 60 or 65.

Every super fund will have a different process for this, the standard requirement is to complete a form or statutory declaration declaring that the person can not work to the same level they could before the accident/injury and to have 2 doctors sign forms confirming the same thing. Some super funds will be more experienced with this process than others.

- Superannuation Income Stream

Most Australians are limited to rolling over $1.7 million into a super income stream and can only do this after age 60. However, as long as the personal injury recipient can meet step 2 above, they can commence a super income stream – and these funds are excluded from the $1.7 million Transfer Balance Cap. This means the personal injury recipient can have their entire personal injury settlement funds PLUS the $1.7 million in a tax-free super income stream account/s.

Case Study

A recent client of ours received a motor vehicle settlement of $1.4 million. She did not have any immediate plans for these funds and wanted to hold some in cash and term deposits and invest the remainder for the long term.

If she was to hold this $1.4 million dollars in her own name (outside of superannuation), then the interest & earnings will be 100% taxable at marginal tax rates. If the funds earned on average 6.5% pa, this would equate to income of roughly $90,000 pa, which would equate to income tax of over $25,000 every year.

Whereas, if our client invests these funds in a superannuation income stream using the strategy above, she will pay no tax every year.

To illustrate the benefit of this over the long term, if our client doesn’t access any funds over the next 15 years and her average return every year was 6.5%, we estimate she would save well over $500,000 in tax over 15 years by holding her funds in the super/pension account rather than in her own name.

This will be life changing for this person. Furthermore, she is only 20 years old at the moment, she may be able to do some work in future – which will significantly increase the tax savings quoted above (as her marginal tax rate will be higher).

Other Considerations

This strategy doesn’t have to apply just to larger settlements. If the personal injury recipient has taxable income from income protection, workers compensation or other sources, this strategy could also save them significant tax.

One of the main benefits of this strategy is the flexibility. It’s like having a fully tax-free bank account. These people can access this money any time tax free – even if they were to go back to work in future they would not lose this ability.