Tax on TPD Claim Payouts

What you need to know before withdrawing your TPD benefit

How Does the Tax Work?

- Once your TPD claim is approved, it will then be paid into your superannuation account and added to your account balance. There is no tax payable at this point.

- When you then go to withdraw your super and/or TPD insurance you will pay tax if you are under your preservation age – which is between 55 and 60 depending on your date of birth.

- The standard tax rate is 22%, HOWEVER, when you make a withdrawal after a TPD claim, the superannuation fund will perform a “tax-free uplift” calculation, meaning a portion of your withdrawal will be tax free.

- This means everyone will have a different effective tax rate which could be anywhere between 1% and 18%. If you have more than one super account you will have a different tax rate on each one.

Warning: Consolidating your superannuation funds may increase the tax you pay when you withdraw your benefits.

Tax Calculation

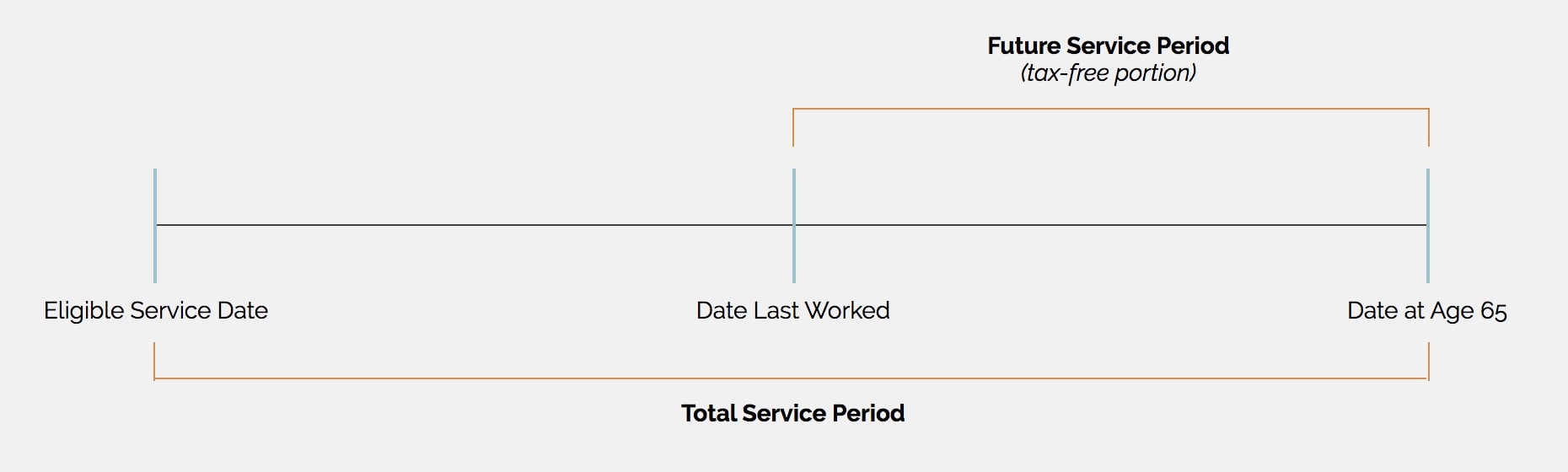

Definitions

Eligible Service Date: Either the date you started your superannuation account, or if you rollover one super account into another, they will take the earlier start date. Beware of consolidating super funds!

Date Last Worked: the date you stopped being eligible of being gainfully employed. Usually this is your employment termination date, rather than the date you became sick or disabled.

Put Simply:

- The future service period becomes the new tax-free component.

- Tax withheld by the superfund will be 22% of the past service period portion of withdrawal.

Our statistics show that in over 30% of cases the superannuation fund has incorrectly calculated the tax rate, usually withholding additional tax. If nothing else it is a good idea to get your calculation checked.

Related Content

Do you want to know more about tax on TPD payouts?

Contact TPD Claims advice today to find out more about tax on TPD payouts.